Fuel Updates & information

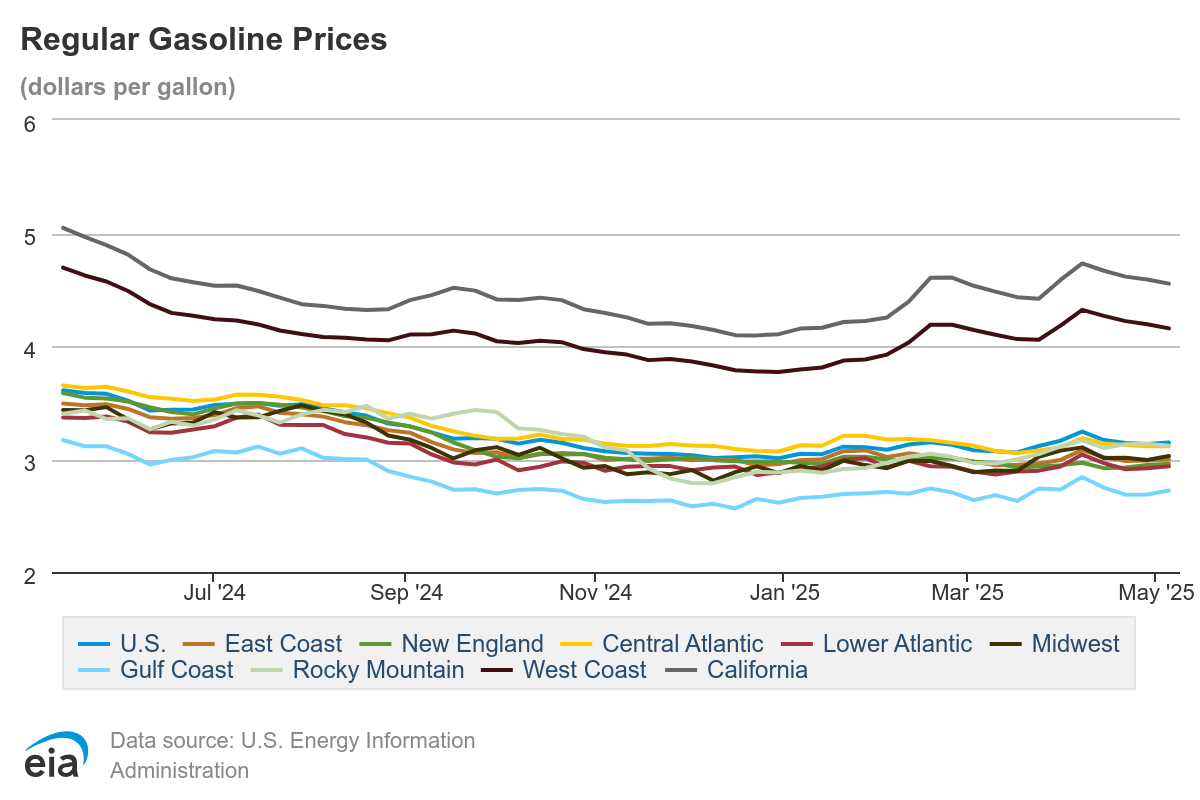

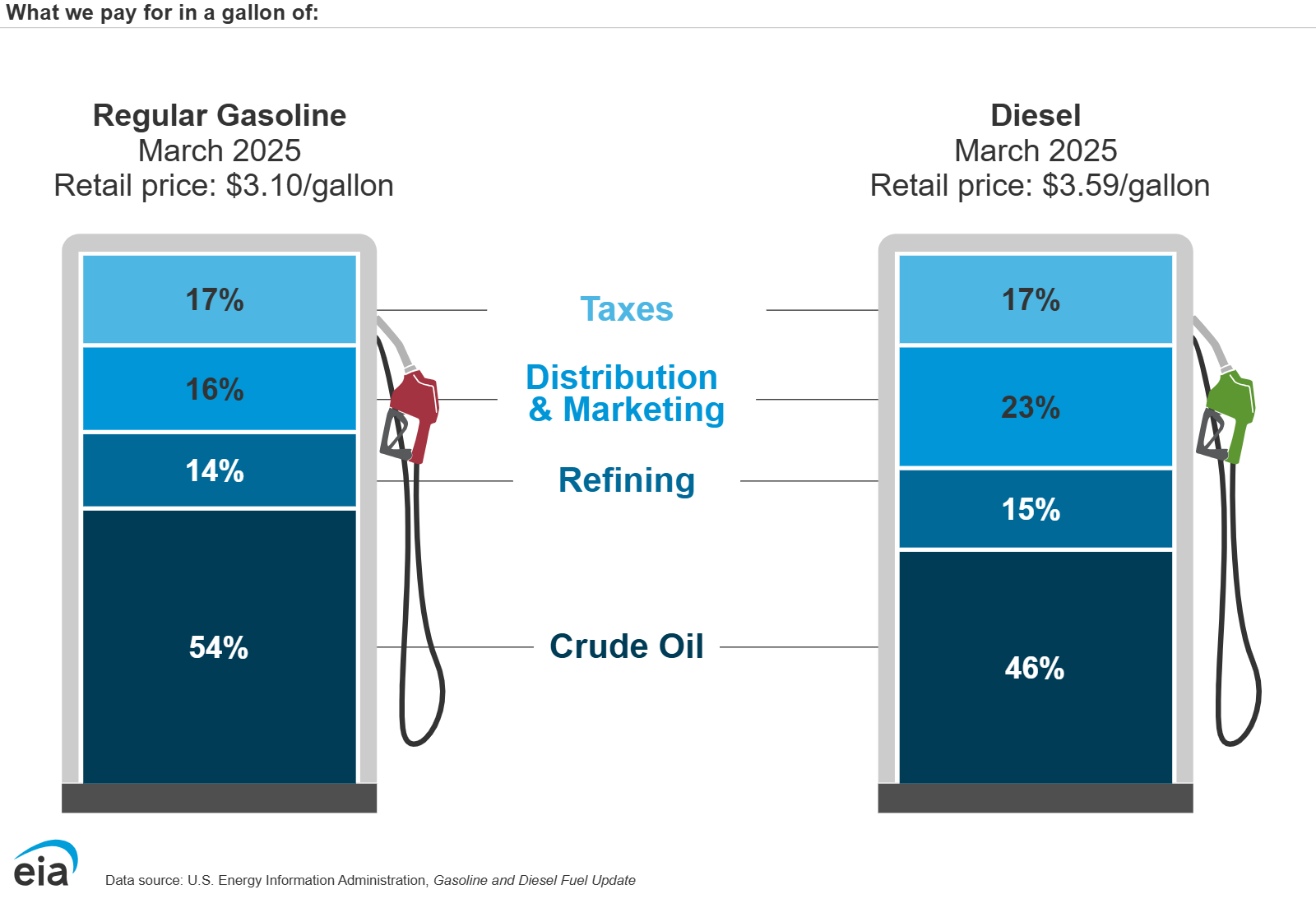

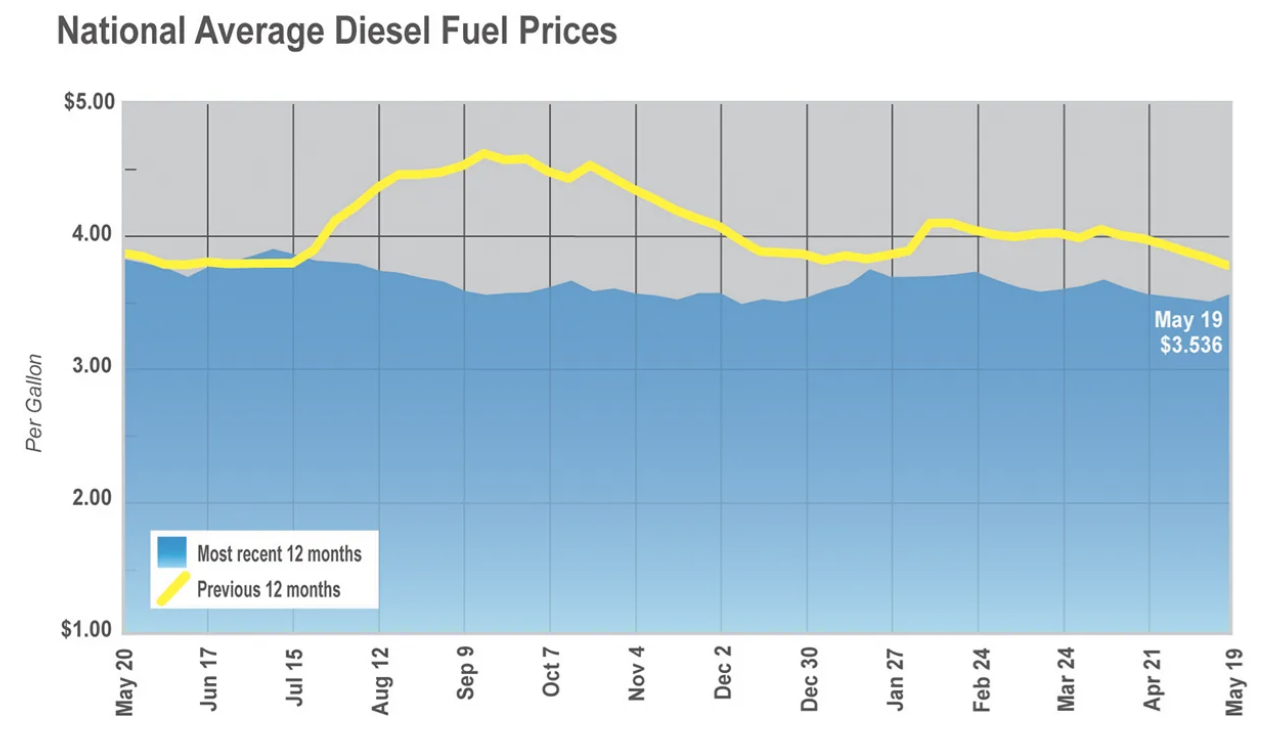

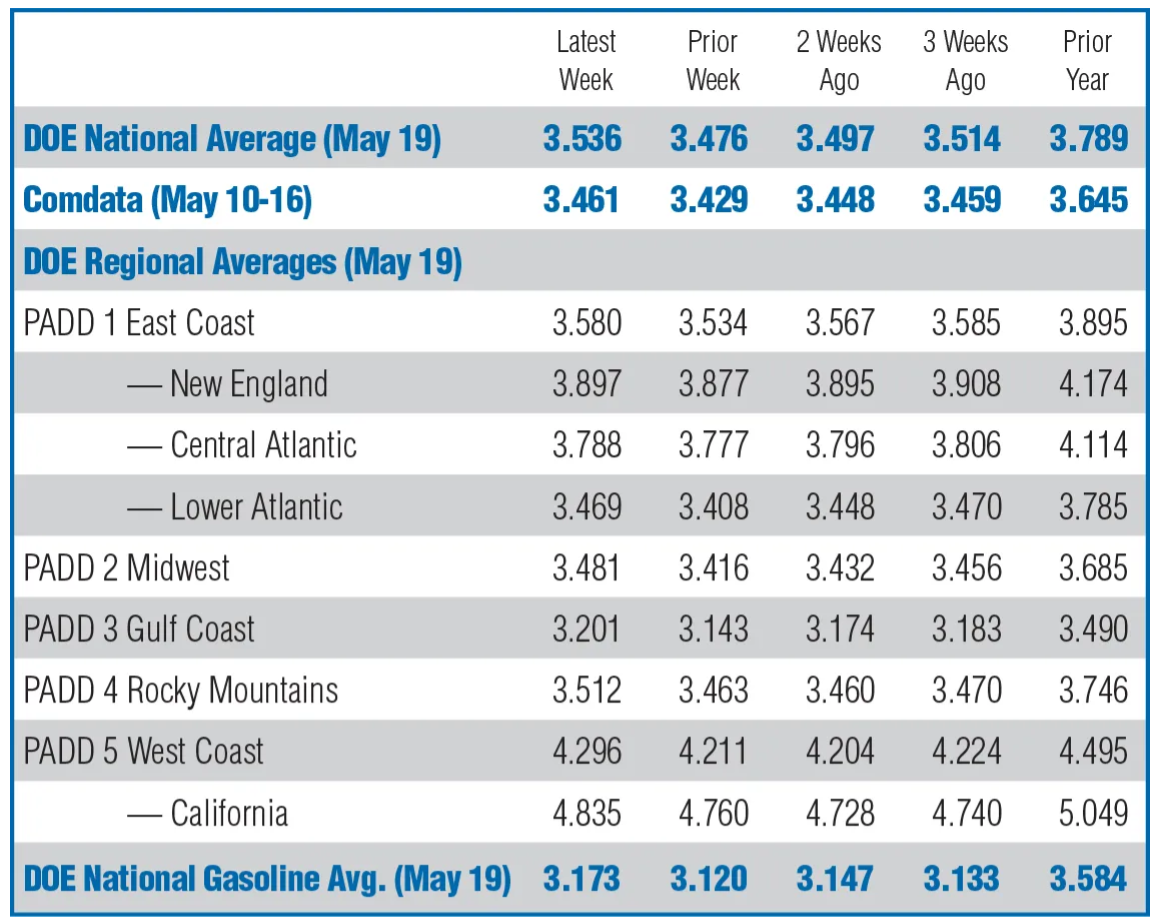

FUEL PRICES FOR WEEK OF May 19, 2025

energy-related articles

Diesel Price Drops 3.7¢ to $3.651 a Gallon

Cost Has Come Down 21.4¢ Since Mid-July The U.S. national average diesel price decreased by 3.7 cents to settle at $3.651 per gallon, according to Energy Information Administration data released Aug. 26. This marks the seventh consecutive week of price declines,...

U.S. natural gas prices calmed after a volatile 2022

Data source: Bloomberg L.P. Note: Annualized percentage, a widely used trading measure of price volatility, is the standard deviation for the previous 30 days of daily changes in the Henry Hub front-month futures price multiplied by the square root of 252 (number...

National Average Diesel Price Falls 5.1¢ to $4.058 a Gallon

Decline Is Largest So Far This Year The national average for a gallon of diesel fell by 5.1 cents the week ending Feb. 26, the largest drop so far this year, according to data released by the Energy Information Administration. EIA says the national average now sits...

In my nearly 30 years of looking at oil markets, I can’t think of a time when geopolitically there was as much uncertainty over potential high and low points in terms of prices, supply, and demand.

Raad Alkadiri

Managing Director, Energy, Climate & Resources, Eurasia Group